flow-through entity tax form

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. The entitys income only goes through a single layer of tax rather than two corporate tax and shareholder tax.

Understanding The 1065 Form Scalefactor

Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest.

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

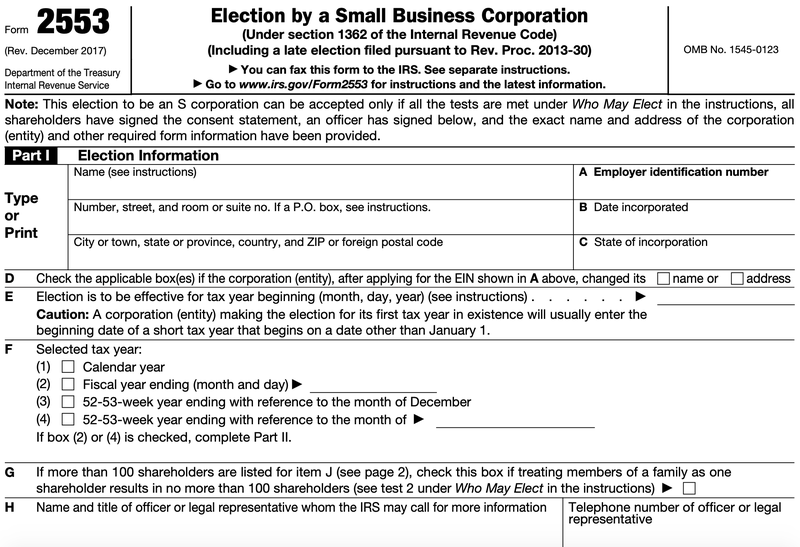

. Instructions for Electing Into and Paying the Flow-Through Entity Tax. Gretchen Whitmer signed legislation on Dec. 1 As a result Michigan is the latest state to enact an entity-level tax regime as a workaround to the federal 10000 state and local tax SALT deduction limitation adopted under the Tax Cuts and Jobs Act TCJA of 2017.

Information must be filed for each member. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

20 2021 to provide an elective flow-through entity FTE tax. The new flow-through entity tax will allow business owners to once again deduct their Michigan income taxes related to flow. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to.

Select Corporation tax or Partnership tax then choose PTET web file from the expanded menu. A pass-through entity that isnt exempt must file all returns electronically. We are developing the following tax forms for qualified entities to make the PTE elective tax payments and for qualified taxpayers to claim the tax credit.

The flow -through entity tax is levied and imposed on certain electing flow-through entities with business activity in Michigan. Do not make 63D-ELT payments on other pre-existing tax types. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. In this legal entity income flows through to the owners of the entity or investors as the case may be. Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap February 03 2022 by Bryan Bays.

It allows ownersshareholders to receive higher net returns on their investment. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021.

Branches for United States Tax Withholding and Reporting. For this purpose aflow -through entity is defined as an S corporation or a partnership under the internal revenue code for federal income tax purposes. With flow-through entities the income is taxed only at the owners individual tax rate for ordinary income.

An entity with a single foreign owner that is disregarded for US tax purposes is not a. Below are a few practical tips for completing Form W-8IMY. On the Form Selection page choose Request for six-month extension to file the pass-through entity tax.

LOG IN TO REQUEST EXTENSION. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. Eligible pass-through entities must register for the 63D-ELT tax type before making a payment.

Information about Form W-8IMY and its separate instructions is at. April 2014 Department of the Treasury Internal Revenue Service. On December 22 Michigan enacted a flow-through entity tax as a workaround to the state and local tax limitations on individuals from the Tax Cuts and Jobs Act.

Session timeout occurs after 15 minutes of inactivity. Branches for United States Tax Withholding and Reporting. Pass-Through Entity Elective Tax Payment Voucher FTB 3893 Pass-Through Entity Elective Tax Calculation FTB 3804 Pass-Through Entity Elective Tax Credit FTB 3804-CR.

Hence the income of the entity is the same at the income of the owners or investors. Per the MI website this tax allow s certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of the entity to claim a refundable tax credit equal to the tax previously paid on that income. If the entity does not have a Business Online Services account the authorized person will need to create one.

Who is eligible to pay the flow-through entity tax. T 1 215 814 1743. October 2021 Department of the Treasury Internal Revenue Service.

Select the Services menu in the upper-left corner of the Account Summary homepage. MORE INFORMATION ON MICHIGAN FLOW-THROUGH ENTITY TAX. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

Governor Whitmer signed HB. The pass-through entity must file its annual return and make the election before filing the 2021 Form 63D-ELT. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has.

Fiscal year flow-through entities elected into the tax will pay quarterly estimated tax on due dates determined in accordance with that entitys fiscal year. The Michigan flow-through entity tax is enacted for tax years beginning on and after January 1 2021. Section references are to the Internal Revenue Code.

Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of the flo. Section references are to the Internal Revenue Code. Finally due to the nature of this retroactive application to 2021 tax situations quarterly estimated payments of tax otherwise due for tax year beginning in 2021 will not accrue any penalty or interest.

Flow-through entities are a common device used to avoid double taxation on earnings. There are two major reasons why owners choose a flow-through entity. The tax base for the flow-through entity tax includes the positive business income of owners who are individuals passthrough entities estates and trusts but not including distributive allocations of loss to a particular owner or the distributive or prorated income allocation to an owner that is a corporation insurance company or financial institution.

Individual resident or nonresident Trust or estate S-corporation. Retroactive to tax years beginning on or after Jan1 2021 the law allows eligible entities to make a valid election and file and pay tax at the entity level giving a deduction against entity taxable income. Advantages of a Flow-Through Entity.

Be sure to continuously input return data to avoid. The payees of payments other than income effectively connected with a US. In December 2021 Michigan amended the Income Tax Act to enact a flow-through entity tax.

Owners can claim a refundable tax credit against the flow-through income providing. For tax years beginning on or after January 1 2021 an authorized person can opt in to PTET on behalf of an eligible entity through the entitys Business Online Services account now through October 15 2021. 2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session.

As part of the electronically filed Schedule 3K-1 and SK-1 forms the pass-through entity will be asked to provide information identifying the member as an.

California Enacts Elective Pass Through Entity Tax Pte Holthouse Carlin Van Trigt Llp

A Beginner S Guide To S Corporation Taxes The Blueprint

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Taxation What Small Business Owners Need To Know

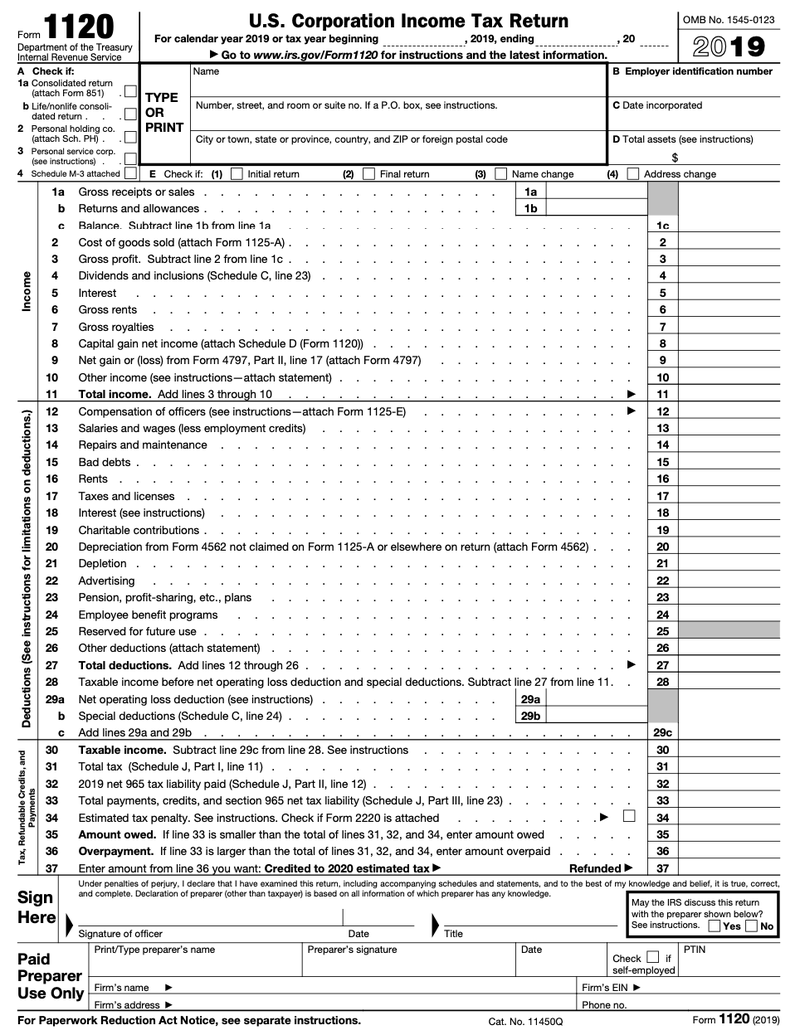

How To File Tax Form 1120 For Your Small Business The Blueprint

Pass Through Entities Fiduciaries Withholding Income Tax Return It 1140 Department Of Taxation

What Is A Pass Through Entity Definition Meaning Example

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Pass Through Entities Fiduciaries Withholding Income Tax Return It 1140 Department Of Taxation

How To File S Corp Taxes Maximize Deductions White Coat Investor

Gov Whitmer Announces New Michigan Pass Through Entity Tax Cohen Company

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

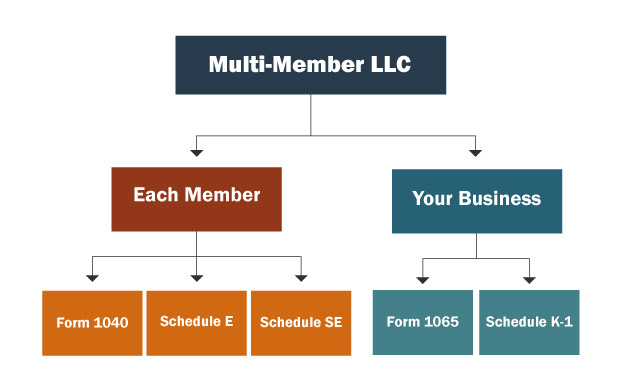

Multi Member Llc Taxes Llc Partnership Taxes

Tax Guide For Pass Through Entities Mass Gov

A Beginner S Guide To Pass Through Entities The Blueprint

How To File S Corp Taxes Maximize Deductions White Coat Investor

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2